Debt recycling has become a popular strategy for individuals looking to optimize their finances and build wealth. However, it is crucial to understand the guidelines set forth by the Australian Taxation Office (ATO) to ensure compliance and avoid any potential pitfalls.

In this article, we will delve into the concept of debt recycling, explore the ATO’s guidelines, discuss the implications of debt recycling, and provide tips for successfully navigating debt recycling strategy.

What is Debt Recycling?

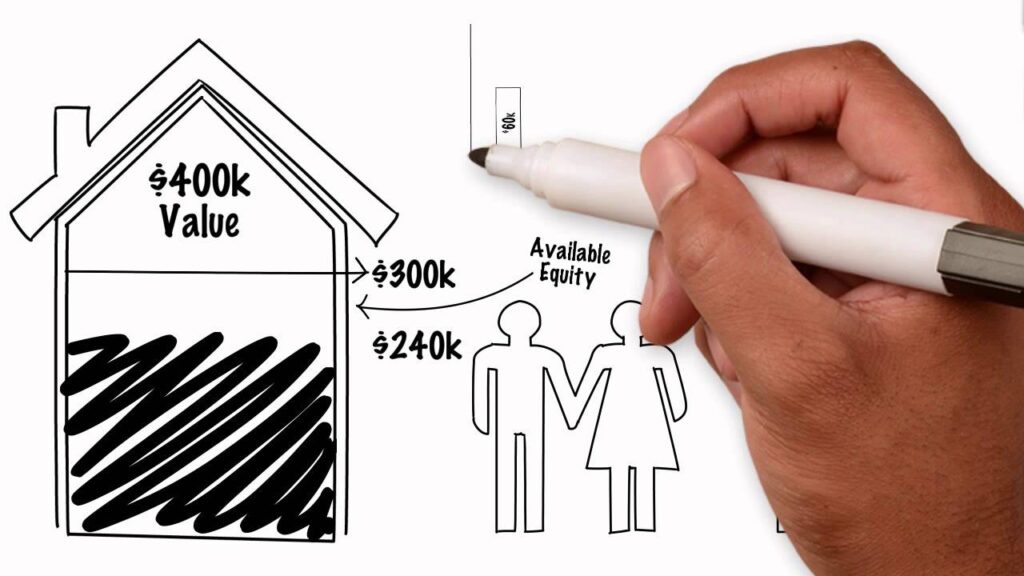

Debt recycling involves using the equity in your home or investment property to accumulate investments and generate wealth. It is a strategic approach that allows you to turn non-deductible debt, such as your mortgage, into deductible debt by utilizing the borrowed funds to acquire income-producing assets.

The Basic Concept of Debt Recycling

The basic concept of debt recycling revolves around utilizing the capital gains made from your investments to pay off your non-deductible debt. By effectively managing your finances, you can ultimately create a situation where your investments are generating sufficient income to cover your mortgage and other debts. This strategy allows you to achieve financial freedom while capitalizing on the potential tax advantages provided by the ATO.

The Role of Debt Recycling in Financial Management

Debt recycling plays a crucial role in financial management as it allows individuals to leverage their assets to maximize their wealth. By effectively recycling debt, you can accelerate your wealth creation and build a diverse investment portfolio that generates a steady income stream. It also provides an opportunity to minimize tax obligations, further enhancing the overall financial position.

Furthermore, debt recycling can be a powerful tool for individuals looking to grow their wealth over the long term. By continuously reinvesting the funds generated from income-producing assets back into new investments, you can compound your returns and significantly increase your net worth. This compounding effect can have a profound impact on your financial future, allowing you to achieve your goals and secure a comfortable retirement.

Another important aspect of debt recycling is risk management. By diversifying your investment portfolio through debt recycling, you can spread out your risk across different asset classes and industries. This diversification helps protect your wealth from market fluctuations and economic downturns, ensuring a more stable financial future. Additionally, by carefully monitoring and adjusting your investment strategy as needed, you can navigate changing market conditions and optimize your returns over time.

ATO Guidelines on Debt Recycling

The ATO has provided guidelines on debt recycling to ensure taxpayers understand their obligations and can effectively comply with the law. These guidelines outline the key principles and considerations individuals should take into account when engaging in debt recycling strategies.

Debt recycling is a financial strategy that involves using equity in a property to invest in income-producing assets, with the aim of creating wealth over time. It allows individuals to leverage their existing assets to generate additional income and potentially reduce their tax liabilities. By following the ATO guidelines on debt recycling, taxpayers can navigate this strategy in a compliant and efficient manner, maximizing the benefits while minimizing the risks.

Overview of ATO’s Stance on Debt Recycling

The ATO recognizes debt recycling as a legitimate wealth-building strategy and allows individuals to claim tax deductions on the interest paid on the debt used to acquire income-producing assets. However, they emphasize that the purpose of the debt and the investments must be clearly distinguishable. This means that individuals must have a clear intention to use the borrowed funds for investment purposes and not for personal expenses.

Furthermore, the ATO encourages taxpayers to seek professional advice before embarking on debt recycling to ensure they fully understand the implications and requirements associated with this strategy. By consulting with financial advisors or tax professionals, individuals can tailor their debt recycling approach to align with their financial goals and circumstances, enhancing the overall effectiveness of the strategy.

Key Principles in ATO’s Debt Recycling Guidelines

The ATO has outlined several key principles that individuals should adhere to when engaging in debt recycling. These principles include maintaining accurate records of income, expenses, and investments, ensuring a reasonable relationship between the borrowed funds and the income-producing assets, and actively managing and monitoring the investments to demonstrate the intention to generate income.

Additionally, the ATO emphasizes the importance of regular reviews and assessments of the debt recycling strategy to adapt to changing market conditions and financial goals. By staying informed and proactive in their approach, taxpayers can optimize the benefits of debt recycling while remaining compliant with tax laws and regulations.

Implications of Debt Recycling

Debt recycling can have significant implications for individuals seeking to optimize their financial situation. By understanding these implications, individuals can make informed decisions and effectively manage their wealth-building process.

Debt recycling is a financial strategy that involves borrowing against the equity in your home or other assets to invest in income-producing assets. This process allows individuals to potentially increase their wealth over time by leveraging their existing assets to generate additional income. By strategically managing their debts and investments, individuals can take advantage of tax benefits and compound growth to enhance their financial position.

Benefits of Debt Recycling According to ATO Guidelines

According to the ATO, debt recycling offers several benefits for individuals. It allows them to convert non-deductible debt into deductible debt, reducing their overall tax liabilities. Additionally, it provides an opportunity to build a diverse investment portfolio and generate income from the investments, leading to long-term wealth creation and financial independence.

Furthermore, debt recycling can serve as a form of forced savings, as individuals commit to using any investment returns to pay down their debts. This disciplined approach can help individuals accelerate the repayment of their debts and build a more secure financial future.

Potential Risks and Downsides

While debt recycling can be a powerful strategy, it is vital to consider the potential risks and downsides. One potential risk is the fluctuation of investment returns, which can impact the ability to repay the borrowed funds. Additionally, individuals must carefully manage their cash flow to ensure they can meet the repayment obligations associated with the borrowed funds. It is essential to weigh these risks against the potential benefits and consult with a financial advisor before embarking on a debt recycling strategy.

Another important consideration is the impact of interest rates on the cost of borrowing for debt recycling. Fluctuations in interest rates can affect the overall effectiveness of the strategy, potentially increasing the financial burden on individuals if rates rise significantly. Monitoring interest rate trends and having a contingency plan in place can help individuals mitigate this risk and adapt their debt recycling strategy accordingly.

Compliance with ATO Guidelines

Compliance with the Australian Taxation Office (ATO) guidelines is paramount when engaging in debt recycling strategies. Debt recycling involves utilizing equity in property to invest in income-producing assets, with the aim of generating wealth and optimizing tax efficiency. Adhering to the ATO guidelines is crucial to ensure individuals can enjoy the benefits of this strategy while minimizing the risks associated with potential tax implications.

Understanding and following the ATO guidelines not only provides individuals with peace of mind but also safeguards them against any potential tax or legal consequences that may arise from non-compliance. By staying informed and proactive in meeting these guidelines, individuals can navigate the complexities of debt recycling with confidence and clarity.

Steps to Ensure Compliance with ATO Guidelines

For individuals looking to ensure compliance with the ATO guidelines on debt recycling, maintaining meticulous records is key. Keeping accurate records of income, expenses, and investments is essential for demonstrating the legitimacy and purpose of the debt recycling strategy. Additionally, documenting the intentions behind the investments made using recycled debt is crucial for transparency and compliance.

Regularly reviewing and adjusting the investment portfolio to align with the ATO guidelines is a proactive measure that individuals can take to uphold compliance standards. Seeking professional advice from financial advisors or tax experts can provide valuable insights and guidance on navigating the intricacies of debt recycling within the bounds of regulatory requirements.

Consequences of Non-Compliance

Non-compliance with the ATO guidelines on debt recycling can have serious repercussions for individuals. In the event of non-compliance, individuals may face penalties, fines, or additional taxes imposed by the ATO. It is imperative for individuals to familiarize themselves with the guidelines and seek expert advice to mitigate the risks of non-compliance and optimize the benefits of debt recycling in a legally sound manner.

By prioritizing compliance with the ATO guidelines and staying informed about regulatory expectations, individuals can navigate the realm of debt recycling with confidence and integrity. Taking proactive steps to uphold compliance standards not only safeguards individuals against potential consequences but also fosters a transparent and sustainable approach to wealth creation through strategic financial management.

Navigating Debt Recycling with ATO Guidelines

Navigating the world of debt recycling can be challenging, especially when trying to adhere to the ATO guidelines. However, with the right approach and mindset, individuals can successfully utilize this strategy to build wealth and achieve their financial goals.

Debt recycling, in simple terms, involves using the equity in your home to invest in income-producing assets. By doing so, you can potentially generate additional income and take advantage of tax benefits. But how exactly does it work?

Let’s say you own a property with a mortgage and have built up some equity over the years. Instead of leaving that equity idle, you can use it to invest in shares, managed funds, or other income-generating assets. The income generated from these investments can then be used to pay off your mortgage faster, creating a cycle of debt reduction and wealth creation.

Tips for Successful Debt Recycling

To ensure successful debt recycling, individuals should consistently monitor their investments and adjust their strategies accordingly. Regularly review the financial position and consider consulting with a financial advisor to optimize the investment portfolio. Additionally, it is crucial to stay updated with any changes or updates to the ATO guidelines to ensure ongoing compliance.

When it comes to choosing the right investments for debt recycling, diversification is key. Spreading your investments across different asset classes can help mitigate risks and increase the potential for returns. It’s also important to consider the time horizon for your investments and align them with your financial goals.

Seeking Professional Advice on Debt Recycling

Given the complexities involved in debt recycling, seeking professional advice is highly recommended. Financial advisors can provide valuable insights and guidance on the best strategies to implement, considering individual circumstances and goals. By working with professionals, individuals can gain confidence in their debt recycling journey and make informed decisions to maximize their financial potential.

Furthermore, financial advisors can assist in navigating the ATO guidelines and ensuring compliance. They can help you understand the tax implications of debt recycling and ensure that you are taking full advantage of any available tax benefits.

In conclusion, debt recycling offers a promising way to optimize finances and build wealth. Understanding the ATO guidelines surrounding debt recycling is essential for compliance and risk mitigation. By following the key principles outlined by the ATO, individuals can navigate the intricacies of this financial strategy, benefit from potential tax advantages, and achieve their long-term financial goals.

See Also: Retirement Planning Checklist Ensuring Nothing is Overlooked